Make America Great! I agree. It's already pretty great, but there is plenty to improve.

But "Again"? What does that mean? When was that era that we want to get back to? I'm not the first to ask.

Some think it refers to the 1950s. Lower-income Americans were catching up with the richer Americans back then. Assuming that's a good thing, it was indeed a good time. Coming out of the war, the working classes had some catching up to do, and catch up they did. Professor Steinhorn of American University, in an article in the Washington Post, says, "It was a time of extraordinary economic growth, with household income rising nearly 30 percent in the four years after World War II and nearly doubling during the decade."

That seems pretty good. And lower-income families gained more than higher-income ones, as shown in this graphic, cited by the Economic Opportunity Institute.

The 50s and 60s were booming. The 70s saw a slow-down, but lower-income families still outpaced the richest ones. Also in the 50s and 60s, income tax rates for the richest Americans ranged from 70% to 91%.

But what happened after that?

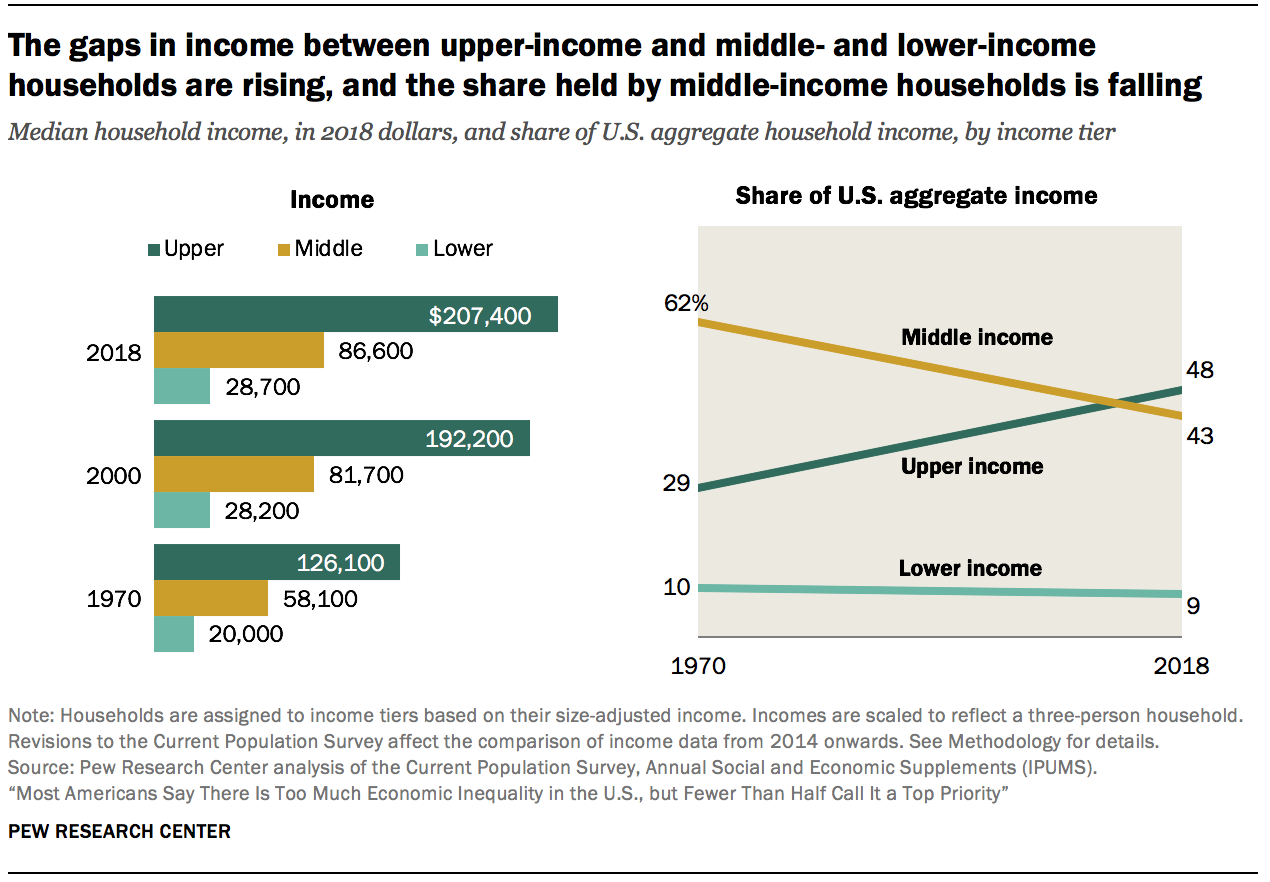

The crash of 2008 pretty much eradicated income gains for all income groups in that decade, but the following decade resumed the rise of the richer folks, while the share going to lower- and middle-income families declined, as shown in these graphs from Pew Research.

The rich did benefit, but the benefits didn't trickle down. You could say it was a failed policy (but you might not want to if you were one of the chosen few).

It is worth noting that the Clinton administration largely continued with Reaganomics. The economy boomed in the 90s and, while lower-income families did better than in the previous decade, they continued to be outpaced by the highest. This trend continued until the recession of 2008 and then picked up again in the next decade.

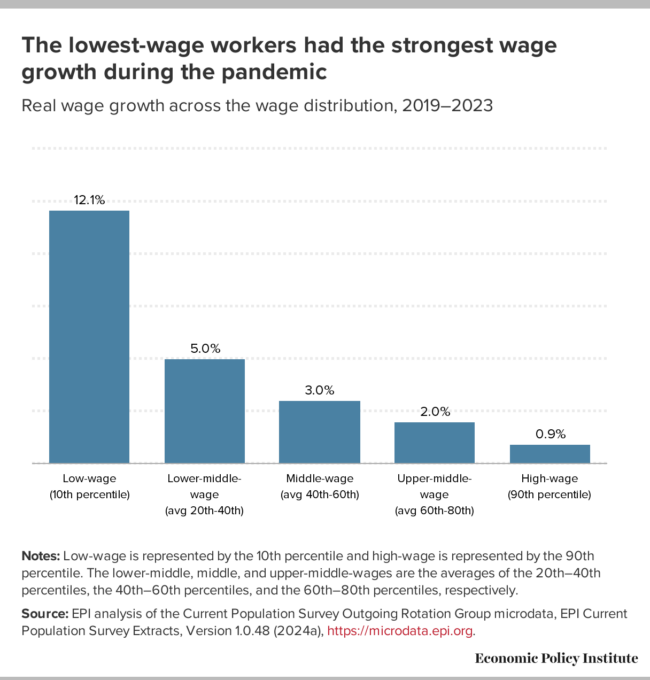

During the Biden administration, Congress has continued to resist tax increases for the wealthy, but the trend in income has changed back to something resembling the 50s and 60s, in part due to high levels of employment. According to a report from the Economic Policy Institute, policy drove much of this turnaround: "Faster growth for low-wage workers did not happen by luck: It was thanks to intentional policy decisions during the pandemic recession." This new trend is dramatic.

It is fair to point out that the pandemic was unique, and this trend may be short-lived. But after 40 years of watching the rich get richer while the poor lost real income under trickle-down economics, it's worth continuing this change in policy. Something is working to make America economically great again, provided you think improving the lot of ordinary folks is a good thing.

I suspect the MAGA movement is not particularly interested in improving the economy for the majority. They might be more interested in resurrecting the McCarthy purges of the 1950s.

Maybe, like J.D. Vance and Representative Grothman from Wisconsin, they just want women and certain voters back in their place.

I don't know, but it seems like retrying some of the economic policies and tax brackets of the 50s could be a good thing. Elon Musk and Peter Thiel and Jeff Bezos and their ilk have had 40 years for their privileged romp. I'm tired of their whinging and tantrums.

Let's keep making America greater. We've got some traction here. Don't slip backwards.